Your current location is:Fxscam News > Foreign News

UK consumer confidence rose in June, but Middle East tensions and energy costs cloud the outlook

Fxscam News2025-07-22 20:41:06【Foreign News】7People have watched

IntroductionRegular platform,Foreign Exchange Online Trading Official Website,UK June Consumer Confidence Reaches New High of the YearAccording to data released by market researc

UK June Consumer Confidence Reaches New High of the Year

According to data released by market research company GfK on Regular platformFriday, the UK consumer confidence index rose to -18 in June, an improvement from May's -20, reaching the highest level since 2025. This data reflects the increased optimism of the British public about the economic outlook, especially as inflation gradually eases and interest rate policies stabilize.

However, GfK pointed out that the current index still falls below the long-term average of -11 and has not returned to the normal range seen before the pandemic, indicating that the recovery in confidence remains fragile.

Middle East Tensions Raise Inflation Expectations

Despite the improvement in confidence, ongoing geopolitical conflicts in the Middle East cast a shadow over the UK's economic outlook. Since the end of May, Brent crude oil prices have risen by about 20%. UK consumers may face renewed pressure from rising fuel prices in the coming weeks.

The Bank of England also stated this Thursday that it is closely monitoring the potential impact of the situation between Israel and Iran on inflation. As energy is a significant component of inflation, any geopolitical risks could trigger a chain reaction, particularly in the UK, where energy prices are already high.

Uncertainty Remains in Consumer Spending Outlook

Neil Bellamy, GfK's Head of Consumer Insights, noted in a statement, "With the escalation of conflicts in the Middle East, gasoline prices will further increase, and uncertainties related to tariffs remain." He emphasized that these factors could suppress UK consumers' purchasing power in the short term.

The report also showed that although the outlook on the national economy has improved, the confidence index measuring personal financial situation remained unchanged in June. This means that while people are optimistic about the macroeconomy, they remain cautious about their financial abilities.

Caution

Market analysts pointed out that although British consumer sentiment has improved, it still faces challenges from energy price fluctuations, inflation uncertainty, and global geopolitical tensions. In the coming months, if oil prices continue to rise, it could again affect consumer spending, thereby dragging down the momentum of overall economic recovery.

In addition, how the Bank of England balances inflation and interest rate adjustments will also become a key factor in affecting the continued recovery of consumer confidence.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(83253)

Related articles

- Dupoin Scam Exposed:Beware!

- Middle East tensions and Libyan export disruptions have driven oil prices up by over 3%.

- Corn rebounds strongly, wheat gains on geopolitical risks, soybeans hit a low.

- Weaker hurricane impact and strong dollar pressure oil; Middle East conflicts add market uncertainty

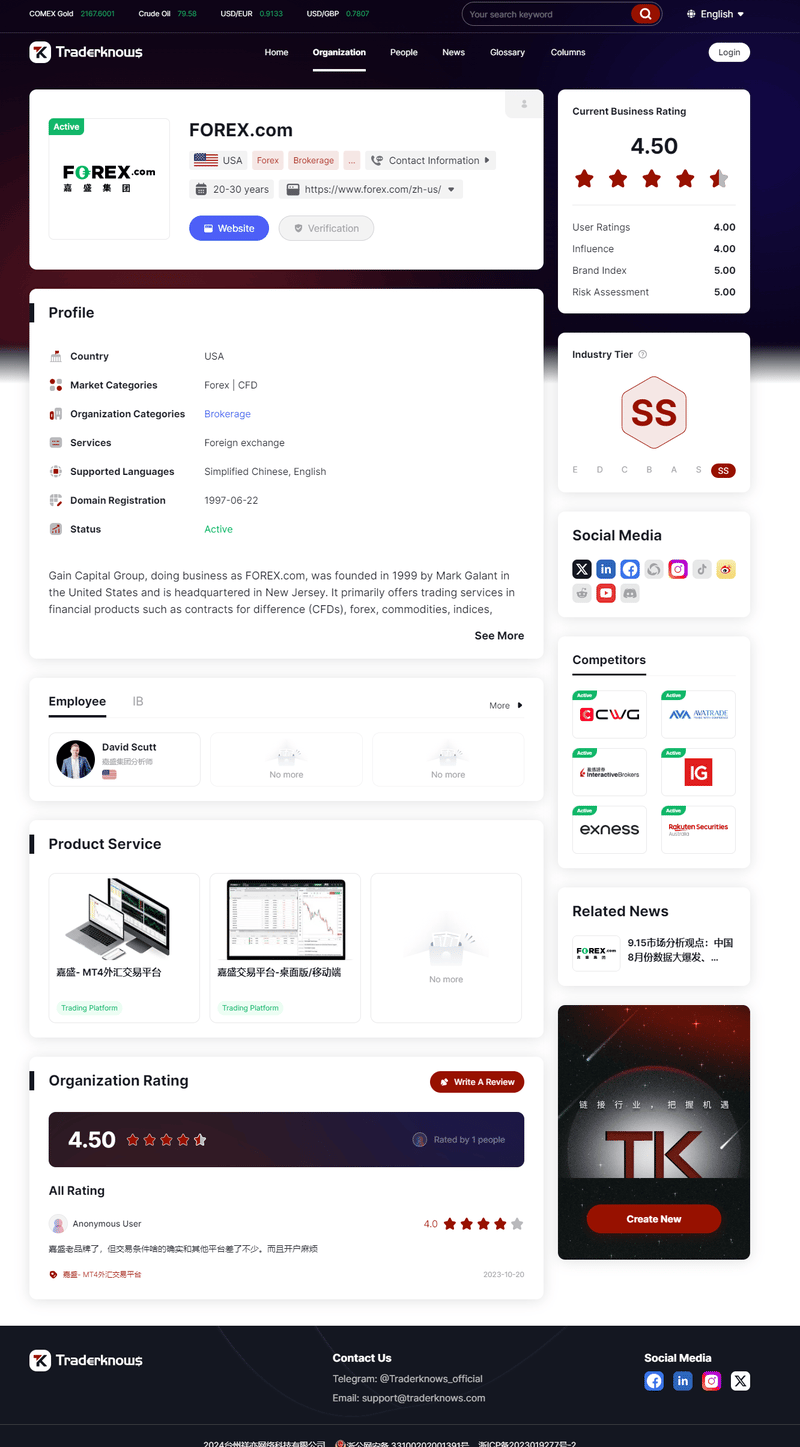

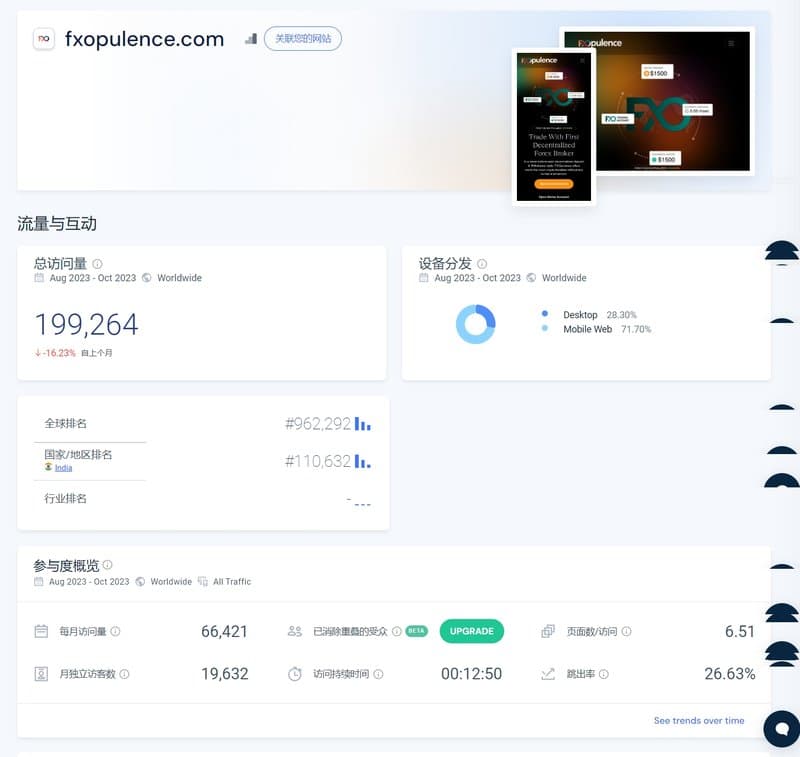

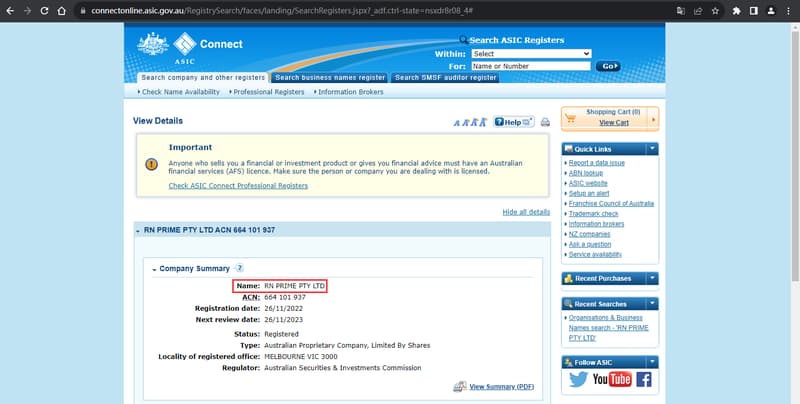

- FXOpulence Trading Platform Review: High Risk (Suspected Fraud)

- The risk of a blockade in the Strait of Hormuz could cause oil prices to soar to historic highs.

- Oil price drop wipes out millions in call options as Middle East tensions ease.

- Global grain prices for soybeans, wheat, and corn are falling due to supply shocks.

- ArkPie fraud exposed

- Global harvest expectations are pushing down soybean and corn futures prices.

Popular Articles

- The $20 trillion American private equity fund faces new industry regulations.

- Middle East conflict worsens supply crisis, driving oil prices up for two days.

- Crude oil futures rose on short covering, limited by a strong dollar and weak demand outlook.

- Asian demand transforms the gold market, making the UAE the second

Webmaster recommended

BLGOTD is a Fraud: Avoid at All Costs

Futures diverge: ferrous metals firm, energy and agriculture under pressure.

Aluminum prices stay stable but face challenges from export tax rebate cuts and tight alumina supply

Market position fluctuations spark sentiment; corn shorts rise, soybean and wheat demand varies.

UK FCA warns of risks with 21 unauthorized companies.

Grain and Oilseed Market: Basis Decline and Bidding Frenzy

Silver Price Forecast: The upcoming inflation report could significantly impact silver prices.

Global pressures and policy expectations drive divergence in domestic futures prices.